Reports / Loan Activity Reports / Collateral Loan Activity

Collateral Loan Activity

The Collateral Loan Activity report provides a detailed overview of loan balances, transactions, and interest calculations for a specified period.

This report is essential for lenders to track and manage loan performance and associated collateral.

If the client has both ABL and MCL loans, the report displays data accordingly, in separate tables.

Navigation: Reports → Loan Activity Reports → Collateral Loan Activity

|

Table of Contents |

To generate a Collateral Loan Activity report, perform these steps:

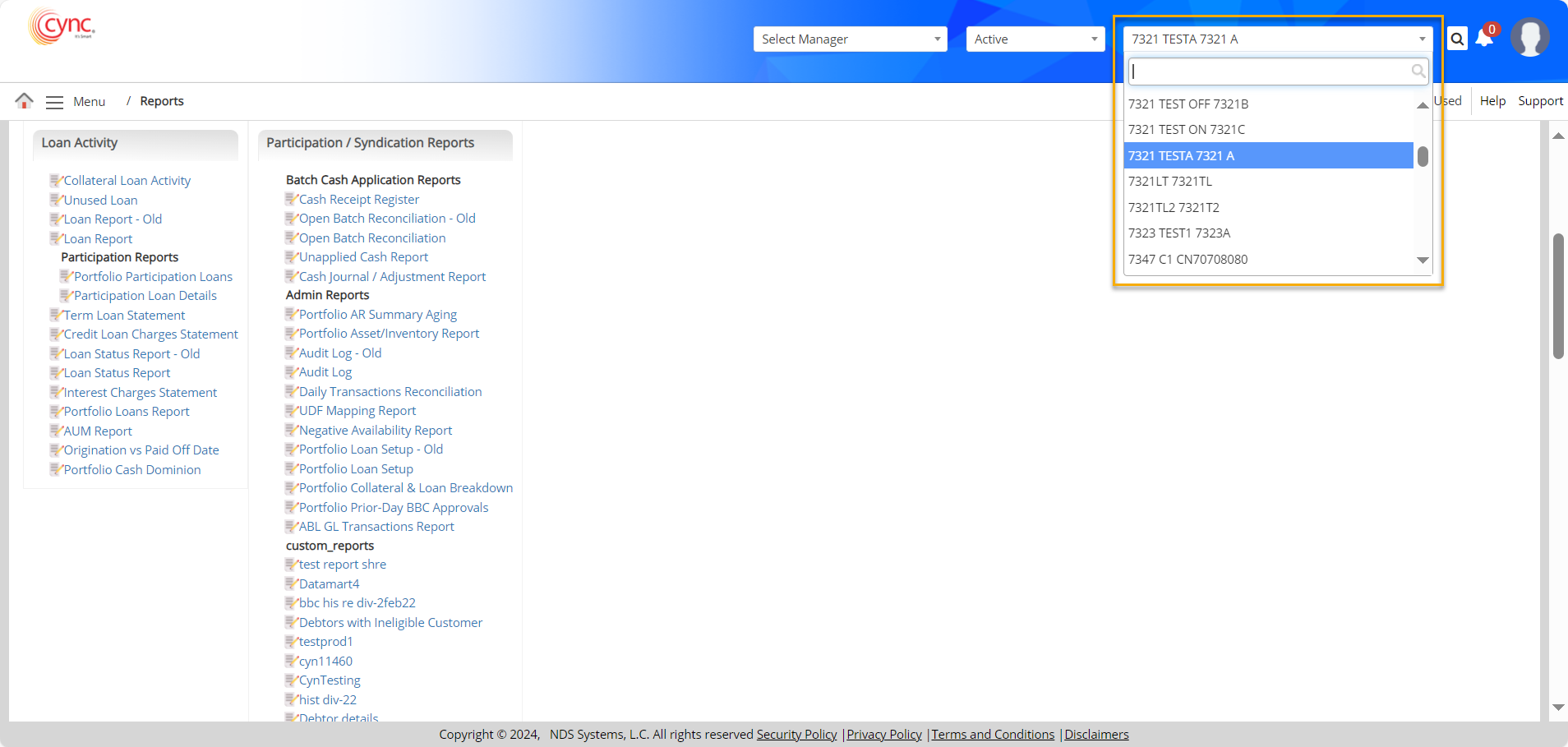

1. On the reports page, select the client in scope.

Refer to the screenshot:

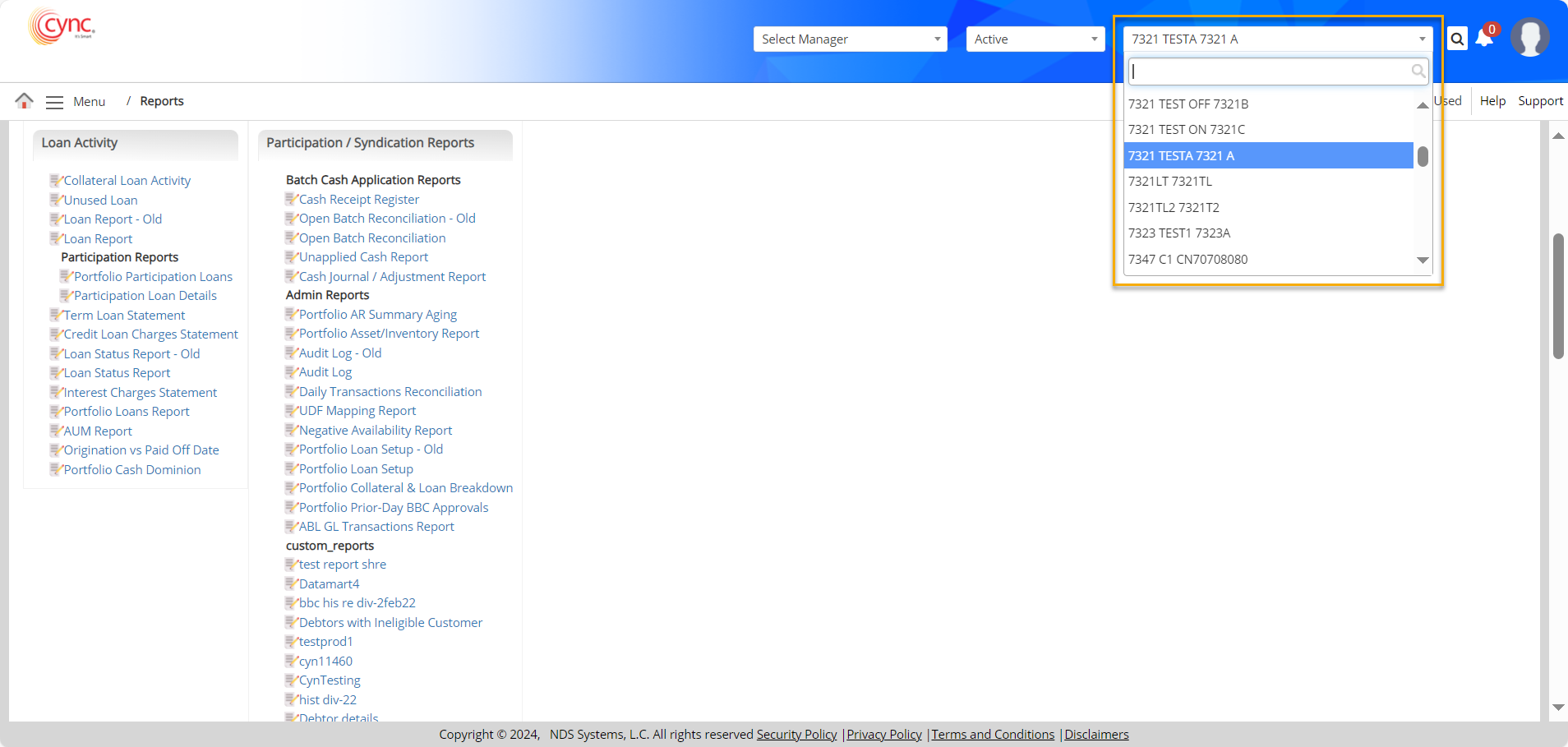

2. Click on the Collateral Loan Activity report under the Loan Activity section. This will open a prompt to select the dates for which the report is needed.

Refer to the screenshot:

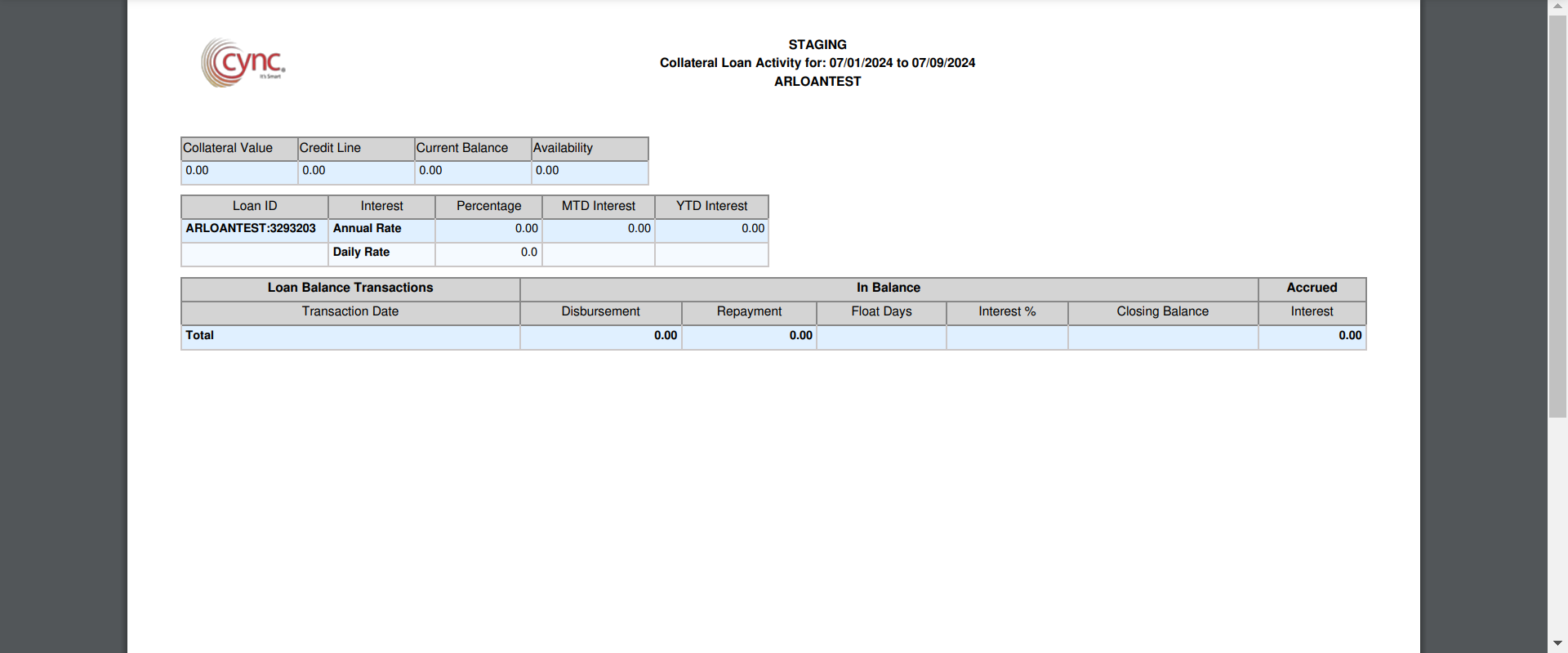

If the report is generated for a client with no approved BBC, then the resulting report will have no data to show:

If the report is generated for a client with no approved BBC, then the resulting report will have no data to show:

There should be an approved BBC for the data to appear.

Refer to the screenshot:

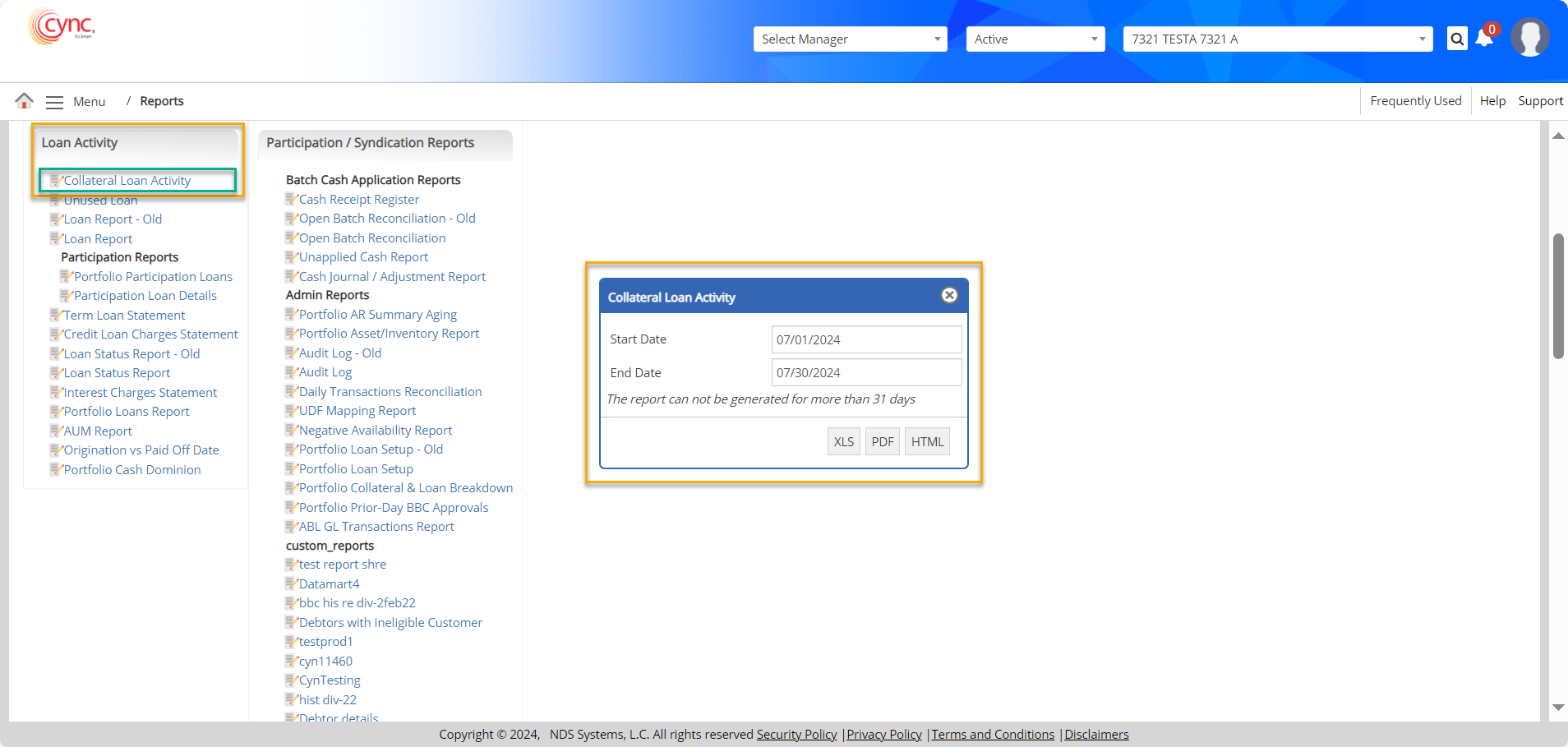

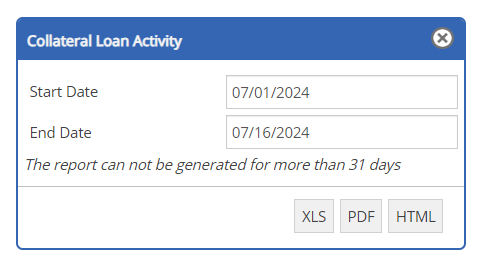

3. Select the start and end date. These 2 fields are a List of values fields. The report will be generated till the selected end date.

Refer to the screenshot:

The start date should be a prior date to the end date.

The start date should be a prior date to the end date.

The start date can’t be a future date,

The report can only be generated for a duration of 31 days.

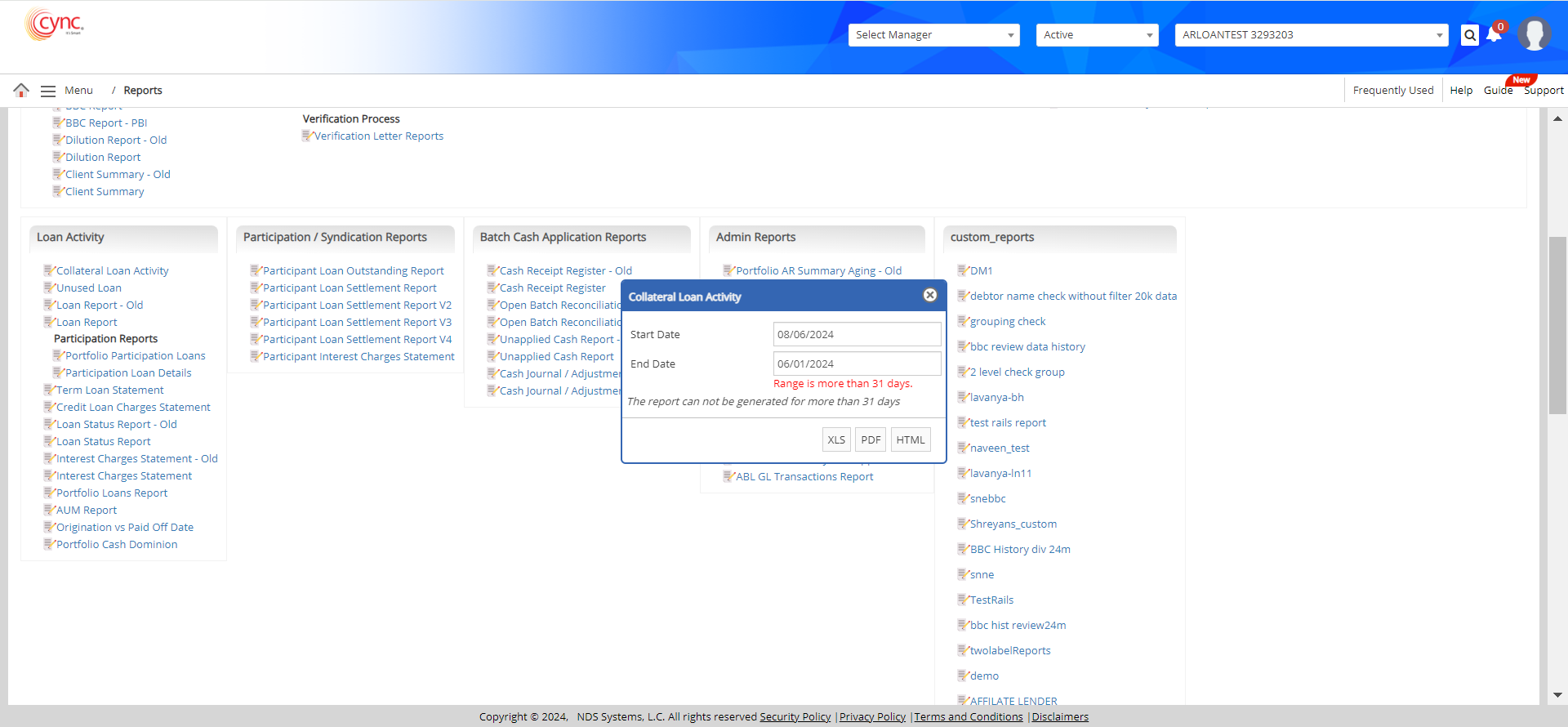

Selecting beyond the range of 31 days will restrict users from generating reports and display an error like below.

Refer to the screenshot:

3. Now, click on the desired output button to generate the report. The CYCN supports, XLS, PDF and HTML file formats.

Refer to the screenshot:

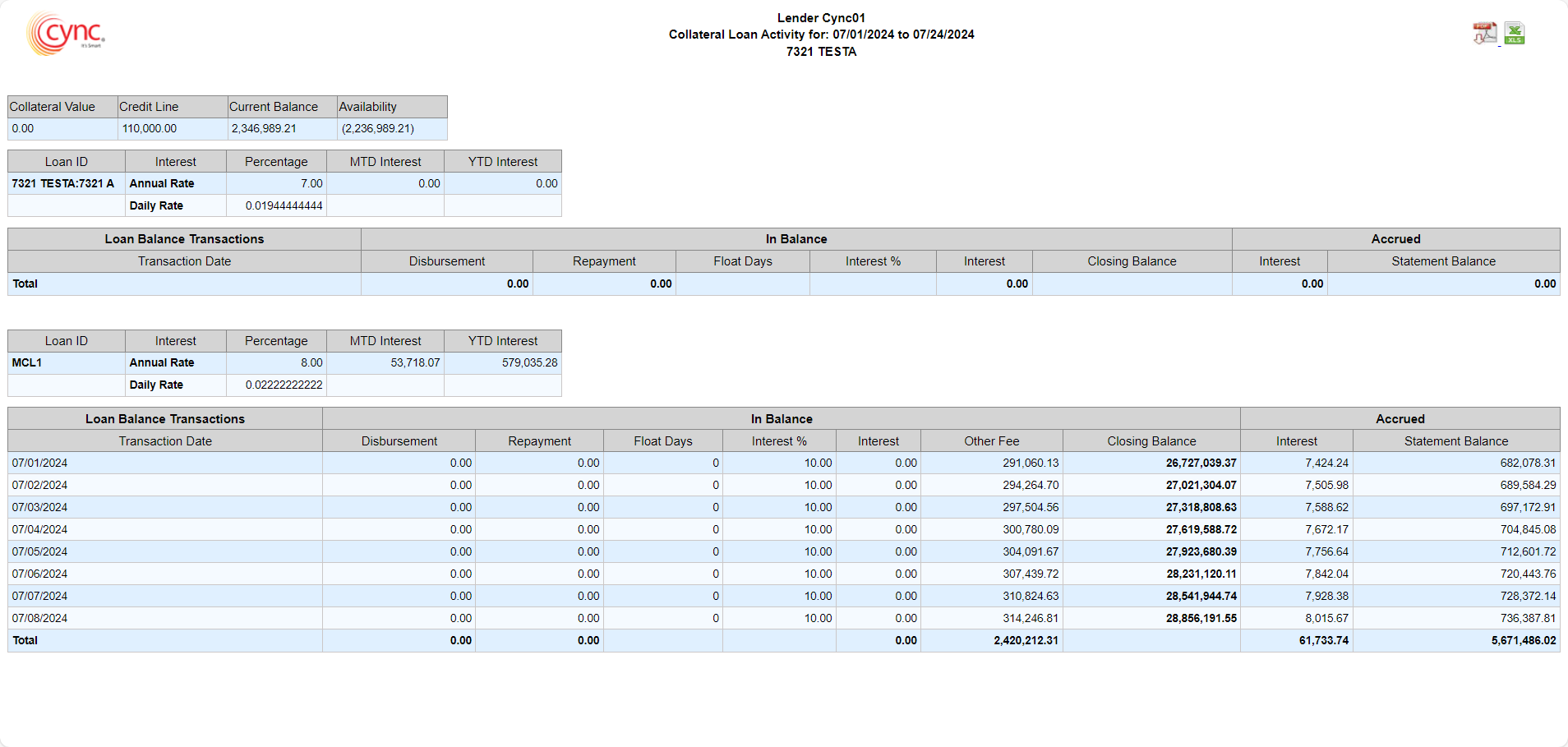

i. Report generated in HTML file format:

Fields and Descriptions

|

Fields |

Descriptions |

|

Start Date |

Allows to define a start date for the collateral loan charges statement |

|

End Date |

Allows to define an end date for the collateral loan charges statement |

|

XLS, PDF and HTML |

Allows to select the output format and generates the output accordingly. |

The report has 3 Sections. Below are the details of the parameters of each section.

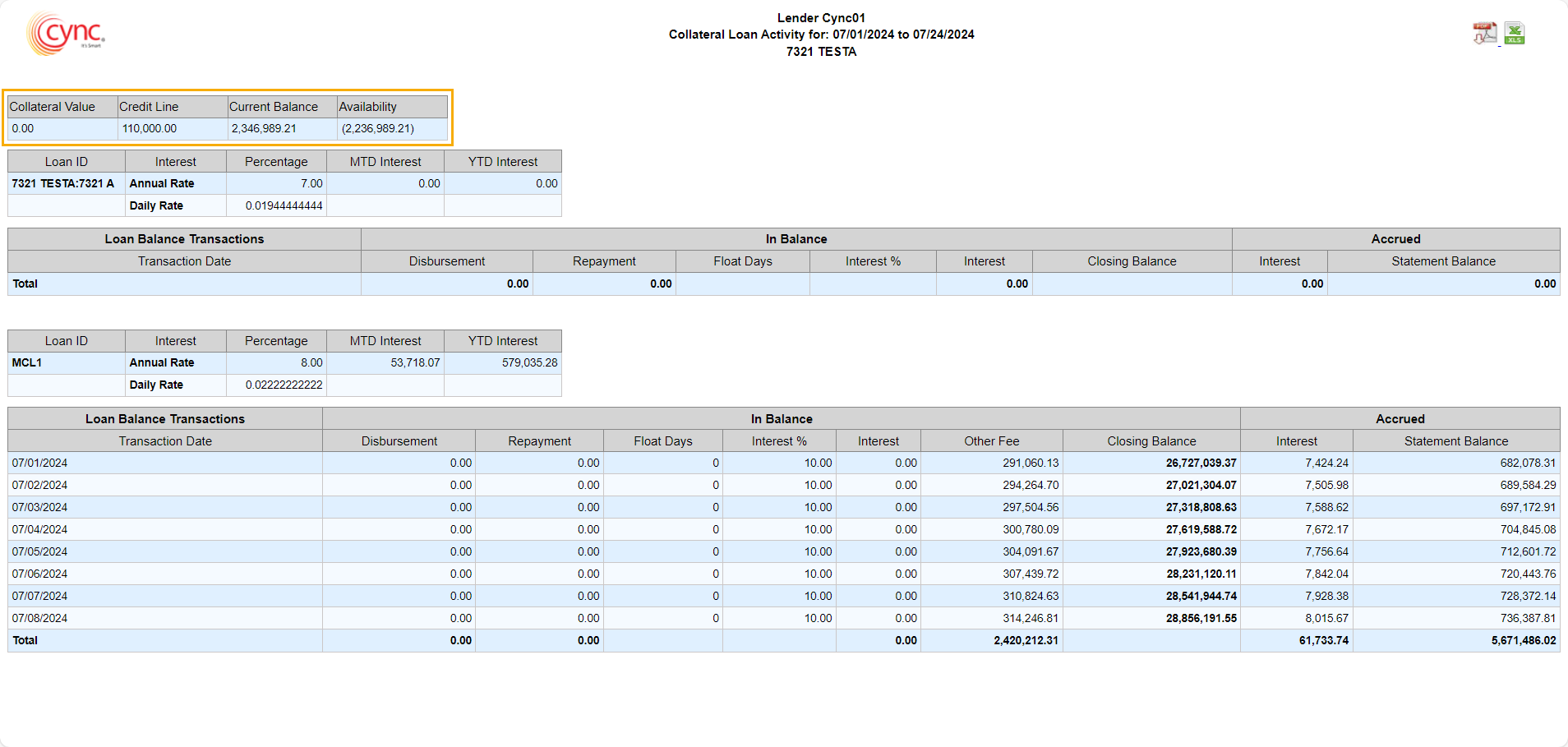

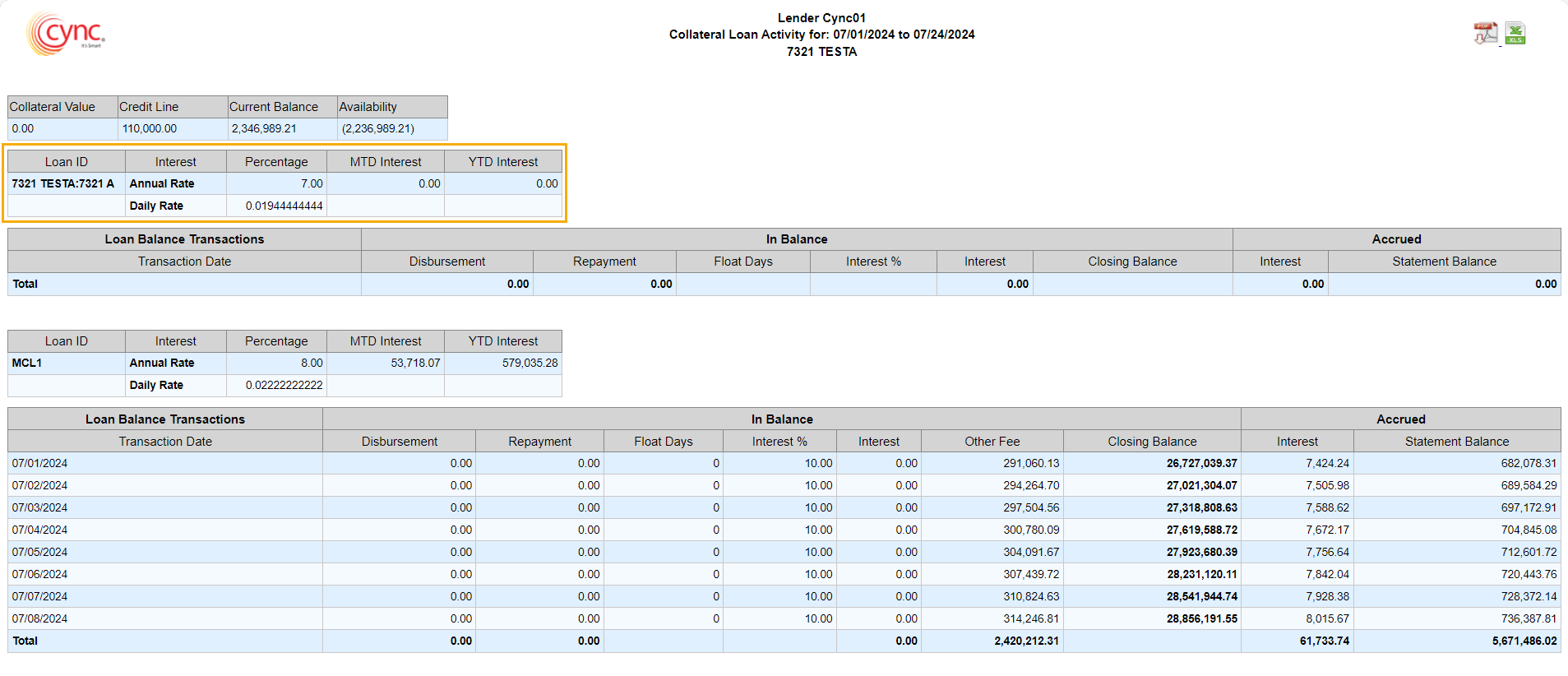

Section 1: Displays the Client level details.

Refer to the screenshot:

Collateral Value: It is the total collateral value of the last Approved BBC, from the BBC Availability page.

Credit Line: The total commitment amount taken from the Line & BBA Reserves page. It is the sum of both the ABL and MCL loan credit line amount.

Current Balance: Displays the current balance value from the Basic Client Details page

Availability: Availability value is calculated as the difference between the credit line amount and the current balance amount.

Availability = Credit Line - Current Balance

Section 2: Displays the Loan level details.

Refer to the screenshot:

Loan ID: Displays the Loan ID of the ABL/MCL loan associated with the client.

Interest: Shows the Annual and Daily interest rate.

Annual Interest Rate: The interest rate applied on the ABL Loan / MCL loan on the Loan Set up page.

Daily Interest Rate: The annual interest rate divided by the number of days in the current year. Can also be configured on the Interest Rate Code page.

MTD Interest: Month-to-Date Interest, is the total interest for the current month.

The value of MTD is calculated by deducting the Interest MTD for the last month from the Interest MTD for the current month on the Interest Payment page.

YTD Interest: Year-to-date interest, is the total interest applied for the current year.

The value of YTD interest is taken from last month’s Interest YTD value from the Interest Payment page.

No value will be reflected for loans that have no transactions recorded during the report period.

No value will be reflected for loans that have no transactions recorded during the report period.

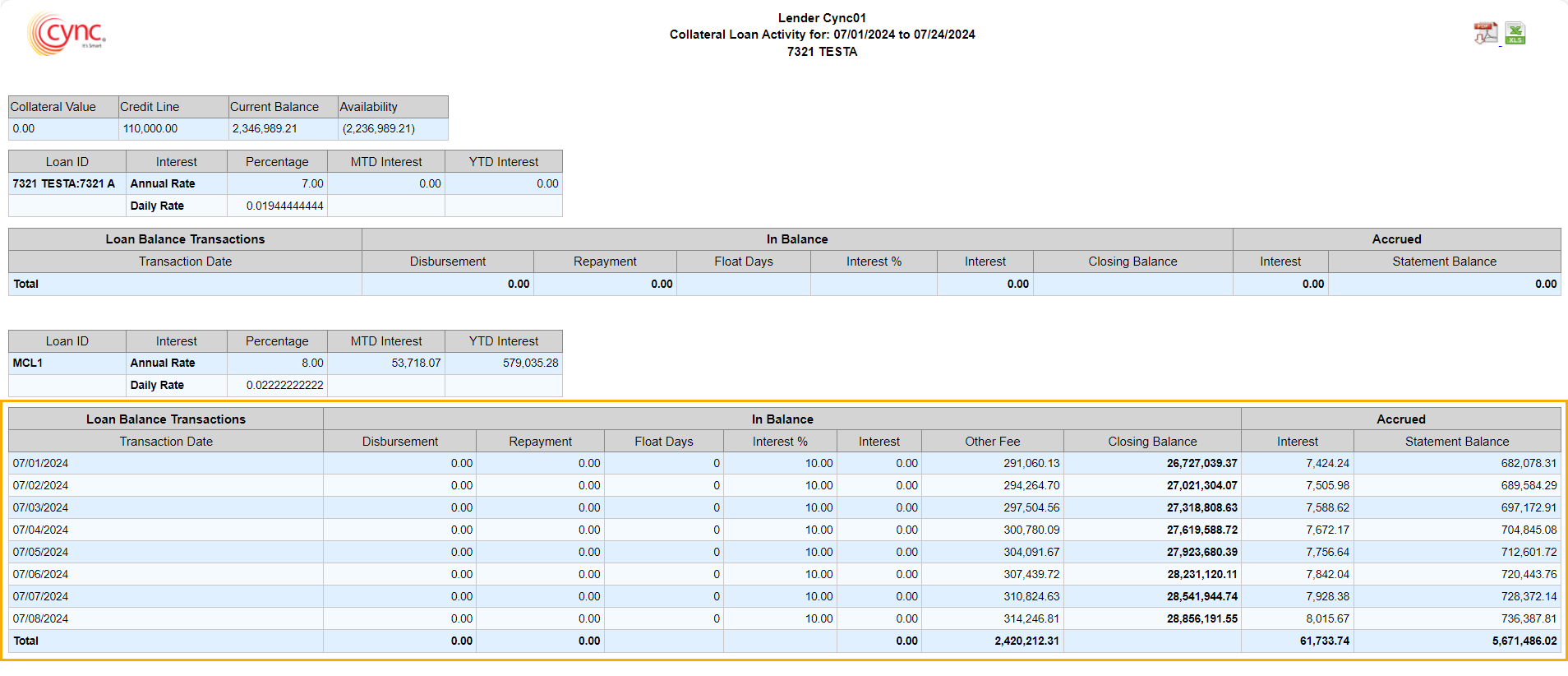

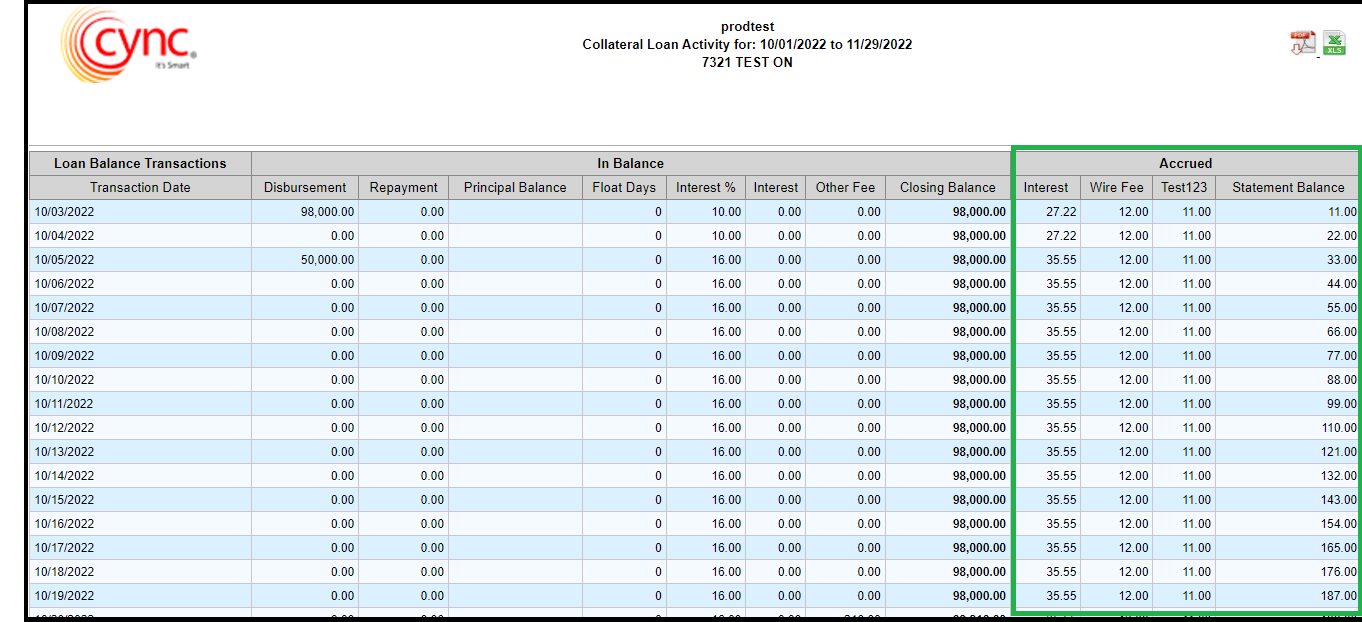

Section 3: Displays the transaction details.

Refer to the screenshot:

Loan Balance Transactions: Displays the transaction dates.

All the Interest and Fees with posting type In Balance are reflected in this section.

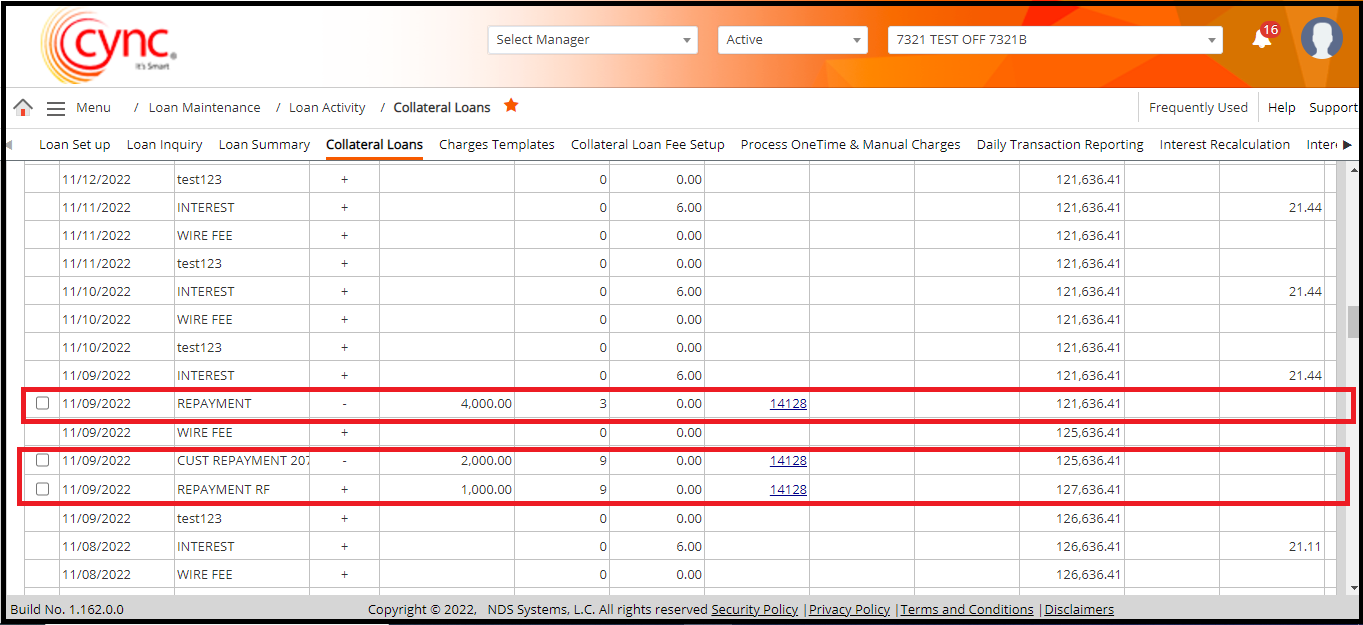

Disbursements: Displays all the Advances done during the tenure of the report. The values are taken from the Collateral Loans page.

Repayments: Displays all the collections done during the tenure of the report. The values are taken from the Collateral Loans page.

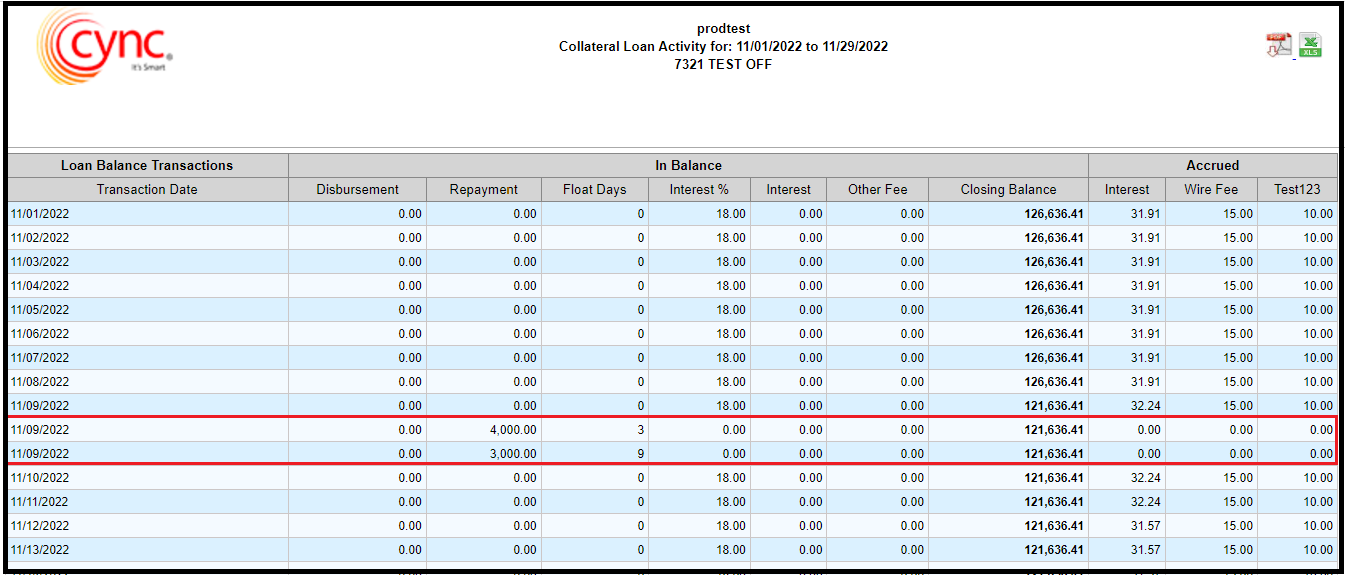

Float Days: Displays the number of float days taken from the Cash Receipt Source Codes page. Float Days will be applied only in the case of collections.

If there is more than one collection on the same day with different float days, the report will group the collections based on their float days and create separate transactions in the report.

If there is more than one collection on the same day with different float days, the report will group the collections based on their float days and create separate transactions in the report.

For example, if there are three collections, and two have the same float days, the system will group the collections with the same float days together, while the other collections will be reflected separately.

Refer to the screenshots:

Interest %: Displays the annual interest rate. If there is more than one loan, then the interest rates will sum up and show compiled data for the dates, where multiple loans have any transaction.

If the Min. Interest Rate field on the Loan Setup page has an interest rate higher than the original interest rate, or the Max. Interest Rate field has an interest rate lower than the original interest rate, the interest rate displayed in the Collateral Loan page will be shown in the Interest % column.

If the Min. Interest Rate field on the Loan Setup page has an interest rate higher than the original interest rate, or the Max. Interest Rate field has an interest rate lower than the original interest rate, the interest rate displayed in the Collateral Loan page will be shown in the Interest % column.

This interest rate may not necessarily match the interest rate selected in the Interest Rate Code field on the Loan Setup page.

Interest: Displays the interest amount with posting type In Balance will reflect in this column.

If the posting type of the interest is "Accrued to Loan," the sum of the total loan amount for the month will be calculated and reflected in this column on the last day of the month.

Other Fees: Displays In Balance fees in the loan. If there is a fee with the posting type "Accrue to Loan," only the sum of the fees for one month will be reflected on the last day of the month.

Closing Balance: Displays the Outstanding/closing balance from the collateral loan page.

Interest: Displays all the interests accrued during the period with posting type as Accrued to Loan and Accrued to Statement.

Fees: Displays all the fees with posting type as Accrue to Loan or Accrued to Statement. Different Fees will have separate columns.

Refer to the screenshot:

Statement Balance: Displays the sum of all the interests and fees with posting type Accrued to Statement for the Loan.

The subsequent tables will display the Collateral Loan Activity report for other loans that the client may have.